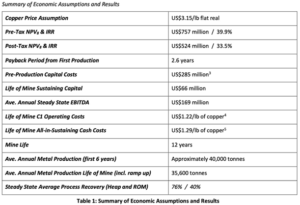

Exceptional PEA Results for the Marimaca Project including US$524 million post-tax real NPV8 and 33.5% IRR

August 4, 2020

Vancouver, British Columbia, August 04, 2020 – Marimaca Copper Corp. (“Marimaca Copper” or the “Company”) (TSX: MARI)is pleased to announce the results of the Preliminary Economic Assessment (“PEA”) for the Company’s flagship Marimaca Copper Project (“Marimaca” or “the Project”), located in northern Chile. The study confirmed that the Project has the potential to be a very low capital and operating cost copper producer. The Company will host a webinar to present the results of the study on Wednesday the 9th of September 2020.

Highlights

- US$524million post-tax NPV8(real) assuming aUS$3.15/lbflat long-term copper price

- Payback of 2.6years

- Post-tax IRRof 33.5%

- US$640millionpost-tax NPV8(real) assuming aUS$3.45/lbflat long-term copper price

- Payback of 2.4years

- Post-tax IRR of 38.0%

- Average annual steady state EBITDA of US$169million

- Pre-production capital cost of US$285million

- Capital intensity of US$7,125/tonne of copper production capacity

- Assumes mining fleet is purchased via lease to own to minimize upfront capital costs

- Profitability Index (NPV/Capex) of 1.8x

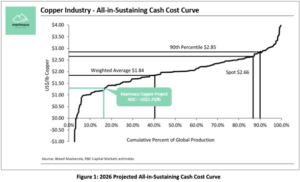

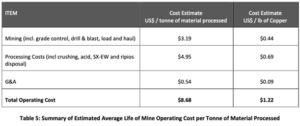

- Life of mineaverage all-in-sustaining cash costs of US$1.29/lb of copper1

- Life of mine average C1 Cash Costs of US$1.22/lb of copper2

- Conventional open pit mining focused exclusivelyon oxide mineralization

- Life of mine stripping ratio of 0.84:1

- Highestgrade feed materials availablein first five years of production resulting in improved payback and overall economics

- Conventionalheap leach, SX-EW, processing circuit

- Projected average life of mine metallurgical recoveries in heap leach of approximately 76% of total copper supported by data from several metallurgical testing programs

- Processmakes use of readily availablesea water

- Average annualsteady statecopper productionover first 6 yrs ofclose to 40,000 tonnes of cathode

- Total mine life of 12 years

- Total recovered copper of approximately 430,000tonnes over the life of mine

- •Significant ongoing exploration potential for both oxide and sulphide mineralization which could substantially extend the mine life of the Project

1 All in sustaining costs is defined as cash cost (C1) plus general and administrative expenses, sustaining capital expenditure, deferred stripping, royalties and lease payments and is used by management to evaluate performance inclusive of sustaining expenditure required to maintain current production levels.

2 C1 cash cost includes all mining and processing costs less any profits from by-products and is used by management to arrive at an approximated cost of finished metal.

The Preliminary Economic Assessment is considered preliminary in nature and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. The PEA is based on the material assumptions outlined in this document.These include assumptions aboutthe availability of funding. While the Companyconsiders all of the material assumptions to be based on reasonablegrounds, there is no certainty that they will prove to be correct or that the range of outcomesindicated by thePEAcanbe achieved.

No mineral reserves have been estimated for the project. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability

Luis Tondo, CEO of Marimaca Copper commented:

“The exceptional results of the PEA have confirmed our belief that Marimaca is a development stage copper project of the highest quality. Its pre-production capital costs placesit in the very lowest tranche of projects in the copper development space, while its low operating costs, which placesit in the bottom quartile of operating copper mines globally, meansthatthe project will be profitable even in lowercopper price environments. “The Marimaca Project is substantially more de-risked than a typical PEA level project due, primarily, to the significant amount of technical work we have already completed, which includes four phases of metallurgical testing, geotechnical studies, nearly 100,000 metres of drilling over the Project and engagement with various input providers for the Project.“In a commodity which is dominated by large, technically challenging projects in difficult jurisdictions, that carry with them a level of development and operating risk commensurate with their size and complexity, Marimaca represents a copper development project at the other end of the spectrum. Marimaca isa project,located in a tier 1 mining jurisdiction, that can be both financed and built with lower levels of execution risk, and which provides a platform for Marimaca Copper to become a mid-tier copper producer in the future.”

Executive Summary of Preliminary Economic Assessment

The Preliminary Economic Assessment (“PEA”) for Marimaca was completed by Ausenco Engineering in conjunction with several Qualified Persons in various technical fields including NCL Ingeniería y Construcción SpA (“NCL”) for mining and mine design and mineral resource estimation,and Jo Loyola Consultores de Procesos SpA (“JLCP”) on metallurgy and process design.

The PEAwas prepared in accordance with the requirements of the National Instrument 43-101,Standards of Disclosure for Mineral Projects,(“NI43-101”)and is based on a Mineral Resource Estimate (“MRE”) completed by NCL, whichcomprised 70 million tonnes, with an average grade of 0.60% total copperwithin the Measured & Indicated Categoriesof mineral resources(approximately 420Kt of contained copper),and 40 million tonnes with an average grade of 0.52% total copper within the Inferred Categoryof mineral resources(approximately 224kt of contained copper) (refer release on 2 December 2019). The Preliminary Economic Assessment is considered preliminaryin nature and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. The PEA is based on the material assumptions outlined in this document. These include assumptions aboutthe availability of funding. While the Companyconsiders all of the material assumptions to be based on reasonablegrounds, thereis no certainty that they will prove to be correct or that the range of outcomesindicated by thePEAcanbe achieved.

No mineral reserves have been estimated for the project. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Marimaca is amenable to bulk, open pit, mining methods and this study contemplates an owner operated fleet utilising a leasingoptionto minimise upfront capital costs associated with fleet purchase. The deposit’s favourable geometry providesthe Project witha low life of mine strip ratio of 0.84:1as well ashigher average gradein the first five years of mine life. This shortens the capital payback period and improves overall economics for the Project.

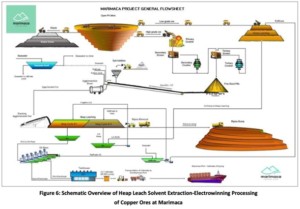

Due to the oxide resource, processing is via a standard heap leach and Run-of-Mine (“ROM”) leach using sulphuric acid and seawater followed by conventional solvent extraction and electrowinning to produce an averageof nearly 40,000 tonnes per annum of high grade copper cathode during steady state production.Heap leach pads are designed as dynamic leach pads where leach residue, known as ripios, are removed after the leaching cycle and stored in a dedicated waste facility. ROM leach pads are designed as static leach pads, with stack height increasing over the life of the mine.

Average recovery over the life of mine for the heap leach is estimated to be approximately 76% of total copper, and ranges from a high of approximately 82% in the pure oxide zones (brochantite / atacamite), which make up the majority of the project, down toapproximately49% in the enriched mineral subzone, which comprises a much smaller proportion of the overall mineable resource.Recovery overthe life of mine for the ROM leach is estimated to be approximately 40% of total copper,comprising 9% of the estimated total copper cathode produced during the life of mine.

3 Assumes mining fleet is financed through a lease to own contract structure to minimize upfront capital cost.

4 All in sustaining costs is defined as cash cost (C1) plus general and administrative expenses, sustaining capital expenditure, deferred stripping, royalties and lease payments and is used by management to evaluate performance inclusive of sustaining expenditure required to maintain current production levels.

5 C1 cash cost includes all mining and processing costs less any profits from by-products and is used by management to arrive at an approximated cost of finished metal.

PRELIMINARY ECONOMIC ASSESSMENT OF THE MARIMACA COPPER PROJECT

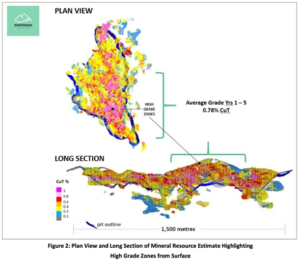

Geology and Mineral Resource Estimate

The MarimacaProject comprises a dominant structural feature of broad zones of sheeted dykes and fracture zones, oriented north-north-east and dipping 45-60oto the east, which host copper mineralisation at surface. The location of the Marimaca deposit is interpreted to be controlled by a dilationalstructural jog and the Company believes that this control applies both to the MOD and to its downwards continuation into the sulphide zone. There is strong evidence that the oxide zones encountered at surface were generated as a result of the in-situ oxidation of primary sulphide minerals, mostly chalcopyrite.

The PEA is based on the MRE, which was released to the market in January 2020 (refer to release on 2 December 2019). The PEAincludes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. The PEA is based on the material assumptions outlined in this document. These include assumptions aboutthe availability of funding. While the Companyconsiders all of the material assumptions to be based on reasonablegrounds, there is no certainty that they will prove to be correct or that the range of outcomesindicated by thePEAcanbe achieved.

No mineral reserves have been estimated for the project. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

The MRE was based on 346 reverse circulation holes (“RC”) and 39 diamond holes (“DD”) for a total of 91,210m drilled between 2016 and 2019 and was completed at a range of Cut-Off grades by independent consultants NCL Ingeniería y Construcción SpA (“NCL”).To demonstrate reasonable prospects for eventual economic extraction, a series of Lerchs-Grossmann pit shell optimizations was completed by NCL, utilizing appropriate operating costs, recoveries obtained from metallurgical test work, and a long term US$3.00/lb copper price. The resources were estimated only for oxide, mixed, wad and enriched copper mineralization which can be processed by heap leaching (HL) and run of mine (ROM) dump leachingfollowed by solvent-extraction and electrowinningto produce copper cathode. Primary sulphide mineralization occurring in deeper parts of the deposit, which are within the constraining pit shell, is not included in the MRE or for the purposes of this PEA.

* CuT means total copper and CuS means acid soluble copper.Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource technical and economic parameters included: copper price US$3.00/lb; mining cost US$2.00/t; HL processing cost including G&A US$9.00/t; ROM processing cost including G&A US$2.50/t; selling cost US$0.07/lb Cu; heap leach recovery 76% of CuT; ROMrecovery 40% of CuT and a 44°-46°pit slope angle

The deposit has a significant higher-grade zone which occurs from surface in its southern extent and provides a logical target for the early years of mine life at Marimaca. The average grade expected during the first five years of mine life is 0.78% total copper and is dominantly comprised of the main oxide mineral sub-zones of brochantite, atacamite and chrysocolla.

Significant potential exists to increase oxide resources within proximity to Marimaca, but also in the broader claims packages that surround this exciting project. Furthermore, the Company has recently released the results of a high-resolution, dronemounted, magnetic survey, which indicates substantial potential for sulphide mineralization below the Marimaca Oxide Deposit (refer to announcement on 14 July 2020).

Mining

The MarimacaOxide Deposit commences at surface and its geometry means that it is amenable to bulk, open pit, mining methods, which have been contemplated for the purposes of this study. The study considers an owner operated mining fleet based on lease to owncontracts with reputable heavy equipment providers.

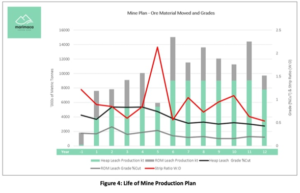

The mine will utilise convention drilling, blasting and shovel loading into trucks on bench heights of 10-20 m depending on location within the open pit. The mine plan was designed to deliver a consistent production profile of approximately 40,000 tonnes per annum of copper cathode during steady state operations.

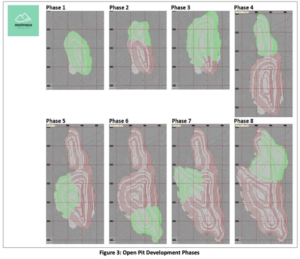

The open pit was designed based on eight phases of development targeting the higher grade, dominantly oxide, mineralisation in the central portionof the deposit area in the early years of the mine life and gradually expanding, and deepening the pit, over the mine life.

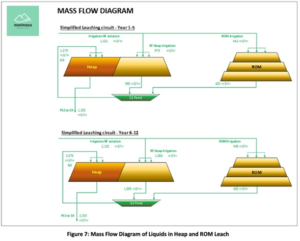

Due to the higher grade of the early years of mine life, the heap leach production tonnes in years 1 to 5 are designed to average approximately 5.4Mtpa before increasing from year 6 onwards to approximately 9.0Mtpa of material. The ROM leach production was designed to be variable to minimize the use of stockpiles, which can add complexity to the mine planning and management, and ranges from a low side of 588ktpa up to a maximum of 6Mtpa of ROM leach material.

The open pithasa low life of mine stripratio (including pre-stripping) of 0.84:1. The strip ratio has decreasedfrom the mineral resource estimate (at a cut-off of 0.22% total copper)because, in mine planning, it was noted that numerous areas of mineralized waste (less than 0.22% total copper) are mined in the proposed PEA mine plan. Although they may be considered as marginal on the heap leach, these tonnes are considered to be economic on the ROMleach, where the additional costs of crushing and agglomeration are removed. As a result, these tonnes, which would have previously been classified as waste, have now beenclassified as mineable resource for the purposes of copper production.

Based on the geotechnical information obtained from the extensive drilling campaigns conducted at Marimaca, the mining area was divided into three clear geotechnical zones. In Zone 1, due to favorable geotechnical conditions the overall pit slope angle wasdesigned at approximately 52 degrees utilising double benching at 20m heights and face angle of 75 degrees. In Zone 2, the overall pit slope angle was reduced to approximately 42 degrees utilising 10 m bench heights and a bench face angle of 70 degrees. Zone 3 was similar to Zone 2, but with a bench face angle of 75 degrees, which slightly increased the overall slope angle to nearly 45 degrees.

In general, the rocks encountered in the hanging and footwall zones appear to show a good degree of competency, but further geotechnical work will be required to confirm these design parameters for future studies.

Metallurgical Testing

The Company has completed three phases of metallurgical test work between April 2017 and March 2018, with a fourth phase completed in July 2020. The results of Phases 1, 2 and 3 were included in the NI43-101 Definitive Feasibility Study for Marimaca 1-23, released on the 29th of June 2018.Phase 4 metallurgical testing is underway.

These tests have been carried out by GeometS.A., a well-known Chilean laboratory with considerable experience in metallurgical programs for copper deposits in Chile. Phase 4 has been designed and executed under the supervision of Marcelo Jo of Jo & Loyola Process Consultants, who has 35 years’ experience in processing. He is supported by Randolph E. Scheffel, a Consultant Metallurgical Engineer with over 45years’ experience in copper processing.

The tests in Phases 1,2 and 3 were completed on materials obtained from Marimaca to characterise the metallurgical response of the deposit to different operational conditions.Samples were selected to consider the various mineral subzones defined at Marimaca, classified based on dominant mineralogy, including oxide, wad, mixed and enriched.The first threephases were performed on a variety of parameters including agglomeration conditions, granulometry, column height, irrigation rates and acid consumption. These tests were followed up with more detailed analysis including bottle roll Iso-pH tests. For thesetests, samples were also selected to consider the various mineral subzones defined at Marimaca including oxide, wad, mixed and enriched.

The fourth phase program comprised broader, more detailed and rigorous tests, includingmini and full-scalecolumn tests with and without seawater.

While the PEA has been based, primarily,on the metallurgical results from Phases 1, 2 and 3 metallurgicalprograms(refer to announcement from 24 June 2020), the recent results from the Phase 4 program have confirmedthat the materialfrom Marimaca is amenable to heap leaching with sulphuric acid, with relatively fast leach kinetics, industry averageacid consumption, relative to similar materials, and expected recoveries of approximately76% of total copper across the life of mine. Recoveries are variable across mineral sub-zones and are expected to be highest in the dominant brochantite/atacamite zones, at approximately 82% of total copper, and lowest in the enriched zones, at approximately 49%. The LOM recoveries for the ROM leach is expected to be 40%.

Processing

The PEA contemplates the recovery of copper using a conventional heap and ROM leach followed by standard solvent extraction and electrowinning to produce high grade copper cathode.Due to the desert location, with limited flora and fauna, the project considers the use of seawater, pumped less than 25km from the coast, meaning no local aquifers will be exploited.

Coarse heap leach materialis trucked from the open pit to be fed directly into theprimary crushing plant. It is then crushed using a two-stage crushing processin closed circuit with screensto achieve sizing of P80passing half an inch following which it is sent for agglomeration using sulphuric acid diluted with seawater. Given the low quantity of fine materials and clays observed in the mineral typesto be mined at Marimaca, it is expected thatthe risk ofgeneration of impermeable layers and occurrence of channelling, which can negatively impact heap leach recoveries,will be minor. Agglomeration is used primarily tocreate an agglomerated material with fines attaching to the coarser material, which also improves stability and to add sulphuric acid to the heap leach material prior to stacking on the leach pads. Lower grade ROM material, which is not considered to be economic through the crushing and agglomeration steps, is sent directly to the ROM leach pads without further preparation.

A stack height of 4 metres was consideredas the design basis for the heapleach pad(s)and up to 20 metres high for the ROM leach pads. The ROM leach pad is designed to be a permanent pad, while the heap leach pads are designed to be on-off(dynamic)pads, which have become verycommon in heap leach operations in Chile, where the leached residues (known as ripios) are removed from the pads and stored in a dedicated waste facility.

The leaching pad areas will be designed in two stages based on the feedgrade delivered from the mine plan. In the first stage, which is designed for the higher-gradematerialsavailable in thefirst five years of mine life, the design contemplates 11leach pads with a total surface are of 308,000 m2. In the second phase, which includesyears six to twelve, an additional 7leach pads are constructed,increasing the total surface area to 504,000 m2. The larger footprint takes into account the higher tonnage and lower expected grade which will be processed during the second half of the mine life in order to ensure a consistent production profile of approximately40,000 tonnes ofcopper per annumisdelivered to the SX-EW plant. Both heap and ROM leach pads are irrigated using a conventional recycled raffinate from the solvent extraction phase with additional sulphuric acid added as required based on the acid consumption profile of the various mineralogiesbeing treated. Leaching occurs in two cycles of approximately 52and 40days respectively for total leaching time of 92days. Following the first cycle, an Intermediate Leach Solution (“ILS”) is recirculated through the heap leach before sending the Pregnant Leach Solution (“PLS”) to the SX-EW plant for final processing.

Themainwaterconsumption of the projectit isrelated to theheap leachingprocess. The Company will utilizeseawaterwith an averagerate of 0.25m3/t foroxide feeds, 0.28m3/t forsulphide feeds, and 0.125m3/t of ROM leachfeed.Considering seasonal fluctuations as well as other requirements of water and the variation in amount of materialtreated annually, a nominal feed rate of up to 100l/s is being considered for seawater supply.

The main power consumption of the project will be related to the Electrowinning process. The Company will utilize an average of 123 MWh/year during the first 5 years, increasing to an average of 143 MWh/year for the remaining project life.

Material Storage Facilities

The Company is proposing the use of on/off leach pads which will necessitate the development of a separate wastedumpfacility for the storage of the ripios or leachedresidue. These have been designedusing standard Chilean protocols, to minimise potential leakage into the surrounding environment of any residues which may present an environmental risk.

The ripios wastedumps will haveapproximately a total lined base surface of 1,500,000m2. The stack height of the ripiosstorage facilities will be increased over the 12-year life of the mine and will house approximately 88million tonnes of material stored and requiring future rehabilitation.

Two mine waste storage facilities areas, to be located to the west and south of the pit, were designed for the project. The facilities were designed in 40 m lifts. Each lift will be constructed at an approximate angle of repose of 37°.

A ROM pad area was designed in a flat valley, located in between the mine waste storage facilities, where the ROMleach process will take place. The leaching of this lowergrade material is planned in10-20m lifts. The design of the facility was developed every three 10 m lifts at an approximate angle of repose of 37° and a set-back of 27 m, resulting in an overall slope angle no higher than 22° and a maximum slope height of 100 m.

The mine plan considers the stockpiling of some lowergrade material for later re-handling at the end of the life of mine to the primary crusher for heap leaching. The low-grade stockpile was designed at the toe of the south waste storage facilityat an approximate angle of repose of 37° and a total height of 50 m.

Infrastructure & Location

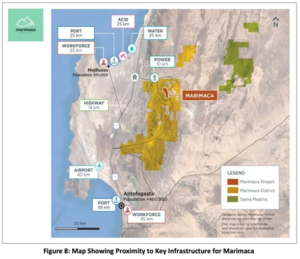

Marimaca benefits from an outstanding location,proximateto all infrastructure required to develop an open pit, SX-EW copper mine. Infrastructure requirements include water supply, power supply, access roads, sulphuric acid supply and other facilities.

Power Supply

The PEA contemplates that the power required for the project will be taken from the national grid, which provides stable, low cost,electricity. The most convenient connection willbe with an existing 110kV line,which runs approximately 7km to the north of the proposed plant site at its closest point. For this PEA it is assumed a 7km,110 kV, spurline will be built to the mainminesubstation, which will be placed close to the SX/EW plant at the Marimaca plant site. The substation will be 30MWcapacitywith a step down from110kV to 23kVfor distribution around the plant site.

Water Supply

Marimaca Copper has approached several utility companies in the Mejillones area, whichare offering to build, maintain and operate a pipeline from their sea water intake to the Marimaca leaching facility and sell the water to the project at the plant site. The PEA contemplates the installation of a 6km long pipeline extending from an existing third-party seawater pipeline and will discharge into the main water reservoir at Marimaca. The headpond has been designed with a capacity of 40,000m3, which represents 5 days of water feed at normal operating rates. From the head pond,water will be distributed to the different centers within the broader processing facility. One centerwill contain a small reverse osmosis plant to produce fresh water which will be required for a small number of processing stages as well as other installations.

Site Layout and Infrastructure

The PEA contemplates the leach pads, ripios dumps and process plant infrastructure being located in a valley to the west of the Marimaca deposit. The valley provides a relatively flat area, which willminimize the requirement for cut and fill earthworks, while providing sufficient space for the various components of the mine site.

Roads

The Project benefits from several roads which fall under the responsibility of the local and regional governmentand,therefore,are not required to be upgraded or maintained by Marimaca Copper. Marimaca is accessible from Route1, which is a paved highway that joins Antofagasta and Mejillones to the cities further to the north. The Mejillones RouteB-240, which is a non-paved road branches off Route1 to the east.

Approximately 10km to the east of the junction of Route1 and the B-240, there is an existing gravel road which branches to the south and leads to the proposed Marimaca plant site, which is approximately 7km to the south.A similar standard is anticipated tobe used for the construction of internal roads which connect the different mine and plant installations. The haulage road which mine trucks will use to carry the materialfrom the mine to the primary crusher is included as part of the mine design.

Capital and Operating Costs

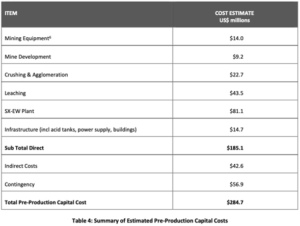

The projected pre-production capital costs for Marimaca, which will be incurred over a 2-year construction period,were estimated on the basis of information from a variety of sourcesincluding direct equipment quotes, derivation from first principles and factoringfrom comparable benchmarks,and aresummarized in the following table:

6 Assumes mining fleet is financed using a lease to own contract structure to minimize upfront capital cost.

The Preliminary Economic Assessment is considered preliminary in nature and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. The PEA is based on the material assumptions outlined in this document. These include assumptions aboutthe availability of funding. While the Companyconsiders all of the material assumptions to be based on reasonablegrounds, there is no certainty that they will prove to be correct or that the range of outcomesindicated by thePEAcanbe achieved.

No mineral reserves have been estimated for the project. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

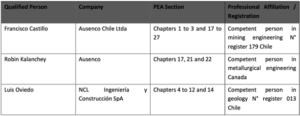

Technical Reporting and Qualified Persons

The NI43-101 technical report will be released within 45 days of this news release and will be available for review on Marimaca’s website and SEDAR. The technical report will be authorised and signed off by the following Qualified Persons:

The QPs confirm that they have visited the Marimaca Project, have verified,and are responsible for,the information contained in this news release and consent to its publication.

Contact Information

For further information please visit www.marimaca.com or contact:

Tavistock

+44 (0) 207 920 3150

Jos Simson/Emily Moss

[email protected]

Notes to Editors

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. These statements relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to, the impact of a rebranding of the Company, the future development and exploration potential of the Marimaca Project. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Marimaca Copper, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project delays or cost overruns or unanticipated excessive operating costs and expenses, uncertainties related to the necessity of financing, the availability of and costs of financing needed in the future as well as those factors disclosed in the Company’s documents filed from time to time with the securities regulators in the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador. Accordingly, readers should not place undue reliance on forward-looking statements. Marimaca Copper undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.