Coro Signs Term Sheet With Minera Aurex for the Payen Copper-Gold Porphyry Project

agosto 8, 2013

News Release 13-08

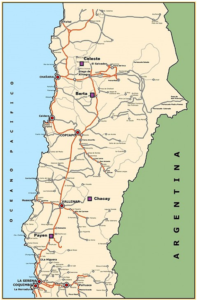

August 8th, Marimaca Copper Corp. (“Coro” or the “Company”) (TSX Symbol: COP) is pleased to announce that its subsidiary, Minera Marimaca CopperChile Ltda. (“MCC”) has signed a Term Sheet with Minera Aurex (Chile) Limitada (“Aurex”), an indirect subsidiary of Freeport-McMoRan Copper & Gold Inc., for Aurex to acquire an interest in MCC’s Payen Property. The 1,225 hectare Property is located approximately 90km NNE of La Serena, 4km W of the Panamerican Highway and approximately 47km from the coast, in the III Region of Chile, at an elevation of 1,100m (Figure 1). Aurex and MCC intend to execute a final agreement on or before September 15th 2013, subject to Aurex’s satisfactory completion of due diligence by September 10th 2013. MCC has granted Aurex an exclusive right to acquire its interest in the property.

Marimaca Copperis also pleased to announce that it has renegotiated the acquisition terms for its El Desesperado porphyry copper project, located 7km NW of Calama in the II Region of Chile.

Alan Stephens, President and CEO of Marimaca Coppercommented, “We believe that Payen has the potential to host a major copper-gold porphyry deposit, and we look forward to seeing the results of Aurex’s exploration program as it develops. This represents further progress in Coro’s strategy of bringing in partners for its projects in these difficult markets, and follows our recent announcements regarding advancing our Berta project to production with an experienced Chilean engineering company as our partner. We are also pleased to have renegotiated the terms of our El Desesperado option, which will facilitate its ongoing exploration. “

Acquisition Terms

As shown on Table 1 below, Aurex may acquire a 70% interest in Payen by completing all of the following;

- – Paying US$16,500,000 in option payments to the underlying Property owner

- – Expending US$13,000,000 in work commitments on the Property

- – Paying US$1,000,000 to MCC

- – Paying an additional US$21,500,000 to MCC upon formation of an operating company owned 70% by Aurex and 30% by MCC to advance the project, immediately after Aurex’s acquisition of its interest.

Table 1: Payen Acquisition Terms (in U.S. dollars)

| Date | Underlying Option Payment | Work Commitment | Payment to MCC |

| On October 10 2013 | $500,000 (firm) | – | – |

| By October 10 2014 | $1,000,000 | $1,500,000 | – |

| By October 10 2015 | $2,000,000 | $3,500,000 | $500,000 |

| By October 10 2016 | $13,000,000 | $8,000,000 | $500,000 |

| On formation of operating company | $21,500,000 | ||

| Total | $16,500,000 | $13,000,000 | $22,500,000 |

The operating company may complete a Feasibility Study to NI43-101 standards on a best efforts basis by October 10, 2019 at Aurex’s expense, at which point MCC will have the option of refunding 20% of the costs of the Feasibility Study to Aurex and thereby own 20% of the operating company, or will immediately dilute to a 2% Net Smelter Return (“NSR”). If MCC elects to refund its 20% share of the Feasibility Study, the operating company shareholders will be responsible for all future costs on a pro-rata basis, or be subject to dilution.

About Payen

The large NE-SW oriented Pajonales alteration zone is located in the same 90-110 million year old belt of porphyry copper-gold deposits as Teck’s Andacollo mine, Cemin’s Dos Amigos mine, PanAust’s Inca de Oro & Carmen projects and Hot Chili’s Frontera project, which is located some 2.5km SE of the Payen property boundary.

The Payen property covers the northeastern third of the Pajonales alteration zone, where it is at its widest, and where the alteration appears most intense. The northern end of the property is transected by a NW fault which has uplifted to the north and exposed a potassically altered and quartz stockworked diorite porphyry with associated copper-gold mineralization. This has been subjected to reverse circulation drilling carried out by the Property owner in 2009, and diamond drilling completed by a private Chilean company in 2011-2012. Results of this drilling were summarized in the Company’s news release of October 17th 2012.

This mineralization is associated with a magnetic high anomaly, and Coro’s exploration has shown that several other similar mag highs are present on the property, coinciding with outcropping mineralized diorite porphyry stocks. Much of the remainder of the property hosts extensive phyllic alteration with outcropping leached cap, quartz stockworking, remnant copper oxides, and associated magnetic low and copper geochemical anomalies. High sulphidation alteration, including phreatomagmatic breccias and silicified ledges with anomalous gold, indicative of a remnant lithocap are exposed at the highest elevations. Previous geochemical sampling has indicated the presence of strongly anomalous copper associated with certain areas of the phyllic alteration, which Marimaca Copperbelieves have good potential to host chalcocite enrichment.

The Property is subject to a 2.5%NSR, of which half (1.25%NSR) may be purchased for US$10,000,000 at any time up to Commencement of Commercial Production.

El Desesperado Project; Renegotiated Terms

Marimaca Copperand the property owners have agreed to reschedule the option payments for the El Desesperado property as shown in Table 2 below.

Table 2: Amended El Desesperado Property Option Payments (in U.S. dollars)

| On or Before | Original | Renegotiated | ||

| 17th February 2012 | $200,000 | |||

| 17th February 2013 | $500,000 | |||

| 17th February 2014 | $1,300,000 | $650,000 | ||

| 17th February 2015 | $3,000,000 | $1,750,000 | ||

| 17th February 2016 | $8,000,000 | $9,900,000 | ||

| Total | $13,000,000 | $13,000,000 |

The El Desesperado property continues to be subject to a 1.95% sales royalty.

Alan Stephens, FIMMM, President and CEO, of Marimaca Copper Corp, a geologist with more than 37 years of experience, and a Qualified Person for the purposes of NI 43-101, is responsible for the contents of this news release.

CORO MINING CORP.

“Alan Stephens”

Alan Stephens

President and CEO

About Marimaca Copper Corp.:

The Company was founded with the goal of building a mining company focused on medium-sized base and precious metals deposits in Latin America. The Company intends to achieve this through the exploration for, and acquisition of, projects that can be developed and placed into production. Coro’s properties include the Berta, Payen, El Desesperado, Llancahue, and Celeste copper exploration properties located in Chile, and the advanced San Jorge copper-gold project, in Argentina. Earlier this year, Marimaca Coppersold its Chacay property to a subsidiary of Teck for US$2,500,000 in cash plus a 1.5%NSR.

For further information please visit the Company’s website at www.coromining.com or contact Michael Philpot, Executive Vice-President at (604) 682 5546 or [email protected]

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements or information, including but not limited to those with respect to the prices of copper, estimated future production, estimated costs of future production, permitting time lines, involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such factors include, among others, the actual prices of copper, the factual results of current exploration, development and mining activities, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company’s documents filed from time to time with the securities regulators in the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

Figure 1: Location of Payen and other nearby Marimaca CopperProperties