Coro consolidates 100% ownership of Marimaca Project and announces C$16.8 million financing

septiembre 10, 2019

NOT FOR DISTRIBUTION TO U.S. NEWSWIRES OR DISSEMINATION IN THE UNITED STATES

Vancouver, British Columbia, September 10, 2019 – Marimaca Copper Corp. (“Coro” or the “Company”) (TSX: COP) is pleased to announce a transaction (the “Transaction”) whereby Marimaca Copperwill acquire from local family owners (the “Sellers”) the remaining 49% interest in the Marimaca 1-23 claim it does not currently own (the “Claim Interests”). The Marimaca 1-23 claim is the central area of the concession package that together comprises the Marimaca Project. Upon the completion of the Transaction, the Company will have 100% control over the claims comprising the entire Marimaca Project.

Pursuant to the Transaction, the Company will acquire the Claim Interests for total cash consideration of (i) US$12 million (US$6 million paid on signing of the definitive purchase agreement and two payments of US$3 million due in 12 and 24 months, respectively), together with (ii) the transfer to the Sellers of certain non-core mineral claims owned by the Company. In addition, the Sellers will receive a 1.5% net smelter return royalty (“NSR”) over the Marimaca 1-23 claim, with Marimaca Copperretaining an option to buy back 1% of the NSR (leaving a 0.5% NSR remaining) for a total of US$4 million at any time up to 24 months from the commencement of commercial production from the Marimaca 1-23 claims. Marimaca Copperwill retain a right of first refusal to acquire this royalty at all times.

In connection with the Transaction, the Company is also pleased to announce a non-brokered private placement (the “Placement”) of an aggregate of 145,863,926 common shares of the Company (the “Offered Shares”) at a price of C$0.115 per share (11.5 cents per share) representing a 28% premium to the C$0.09 closing share price on the TSX on September 9, 2019, for total proceeds of C$16,774,351 (approximately US$12.6 million). The subscribers under the Placement will be the Company’s two largest shareholders, Greenstone Resources LP and associated entities (“Greenstone Capital”) and Ndovu Capital XIV B.V. (“Tembo Capital”). The proceeds of the Placement will be used to make the first US$6 million payment for the Claim Interests, with the balance to be used to advance a mineral resource estimate, a preliminary economic assessment (PEA), other land option payments and general working capital purposes. The confidence of the Company’s major shareholders to invest at a premium is, the Company believes, a testament to the value each sees in the Company and its assets. The issue of 32,481,721 Offered Shares to Tembo is expected to close on or about September 11, 2019. The issue of 113,382,205 Offered Shares to Greenstone is expected to close on or about September 17, 2019.

Highlights

- New transaction consolidates 100% ownership of the Marimaca Project

- Financing at C$0.115 per share (11.5 cents per share) for proceeds of C$16.8 million

- Company working capital bolstered, with the funding secured expected to be sufficient to advance a PEA towards completion in early 2020, in addition to covering other capital requirements

Commenting on the news, Luis Tondo, President and CEO of Marimaca Coppersaid: “Over the last months, while the drill rigs have been turning at Marimaca and unearthing results in excess of what we anticipated, we have also been working hard to increase our ownership of the core Marimaca 1-23 claim from 51% to a full 100%. I am delighted to confirm that this will now be achieved and viewed together with the adjacent land acquisitions and option agreements we have completed over the last 18 months, we have realised our objective to control 100% of the Marimaca Project.

Marimaca 1-23 is only part of the bigger Marimaca story. With drilling from the adjacent La Atómica, Atahualpa and Tarso claims completed, we are now working to complete an updated global resource estimate unconstrained by property boundaries, which we believe will be significantly larger than the original resource, at a similar grade, and with the benefit of near surface high-grade zones identified during the recent drilling campaign. We expect to release this new resource estimate in the fourth quarter of this year.

We have raised money at a premium to our prevailing share price in the face of challenging market conditions. This is one of the best endorsements we could hope for and I am grateful to our shareholders for the support we have received, and I look forward to returning that confidence as we work towards the publication of our new resource and PEA. We approach the coming months from a position of strength as a copper exploration and development play that is well-funded and, in a position, to deliver value to all shareholders.”

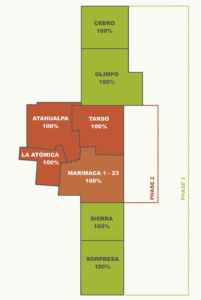

Figure 1: 100% owned Marimaca 1-23 claim and the 100% controlled Marimaca project

The diagram in Figure 1 is a representative illustration of the Marimaca Project and is not to scale

For further information:

The Transaction to acquire the remaining 49% interest in the Marimaca 1-23 claim has been agreed with the Seller through a Chilean public deed which constitutes the framework for a subsequent definitive purchase agreement that will be executed after a corporate reorganization of the Sellers (the “Definitive Agreement”). This is in compliance with Chilean Mining Code and the rules applicable to mining companies.

The price to acquire the Claim Interests has been agreed for the total amount of US$12,000,000, to be paid:

- US$6,000,000 on the date of signing of the Definitive Agreement

- US$3,000,000 within 12 months as from the date of Definitive Agreement

- US$3,000,000 within 24 months as from the date of the Definitive Agreement

Title to the Claim Interests will transfer to the Company upon closing following signing of the Definitive Agreement and payment of the initial US$6,000,000 amount. The Definitive Agreement will provide means for title to the Claim Interests to revert to the Seller in the event that the Company defaults on payment of either of the subsequent US$3,000,000 payments.

In addition, the Seller will have a 1.5% Net Smelter Return Royalty (NSR) over the Marimaca 1-23 claims. The Company will retain a right to repurchase 1% of the NSR (leaving a 0.5% NSR remaining) for US$4,000,000, payable in cash within 24 months from commencement of commercial production from the Marimaca 1-23. The NSR covers only the Marimaca 1-23 claim and no other Marimaca Project claims.

Consideration for the Transaction also includes certain mining claims owned by Compañía Minera Rayrock Limitada, a subsidiary of the Company, which will be transferred to the Sellers, namely:

- Pampa 81, 16-20

- Pampa 81, 36-40

- Pampa 47, 1-5

- Pampa 47, 21-25

- Tiso 1, 1-20

The Pampas claims are part of the Sierra Medina land package and are located approximately 32 kilometers to north east of Marimaca project; and the Tiso claims are part of the RayRock land package and located approximately 26 kilometers to the south of the Marimaca project.

Marimaca Copper and the Marimaca Project

Marimaca is fast becoming recognised as one of the most significant copper discoveries in Chile in recent years as it represents a new style of mineralization which challenges accepted exploration wisdom and promises to open up new frontiers for discoveries elsewhere in the country. Unusually, Marimaca is a fracture controlled and intrusive hosted deposit while the numerous and well known manto deposits in the same Coastal Copper Belt are hosted by favourable volcanic rocks.

With a lack of new copper exploration discoveries in Chile the growing Marimaca resource is likely to make it a sought-after development project as it is located near the coast at low elevation close to the city of Antofagasta and the port of Mejillones. This prime location should enable its future development at a relatively modest capital investment. Marimaca would benefit from nearby existing infrastructure including roads, powerlines, ports, a sulphuric acid plant, a skilled workforce and seawater.

Qualified Persons

The technical information in this news release, including the information that relates to geology, drilling and mineralization of the Marimaca Phase I and II exploration program was prepared under the supervision of, or has been reviewed by Sergio Rivera, Vice President of Exploration, Marimaca Copper Corp, a geologist with more than 36 years of experience and a member of the Colegio de Geologos de Chile and of the Institute of Mining Engineers of Chile, and who is the Qualified Person for the purposes of NI 43-101 responsible for the design and execution of the drilling program.

Contact Information

For further information please contact of visit www.coromining.com or contact:

Nicholas Bias, VP Corporate Development & Investor Relations

Cell: +44 (0)7771 450 679

Office: +56 2 2431 7601

Email: [email protected]

Forward Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. These statements relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to, statements regarding the future development and exploration potential of the Marimaca Project. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Coro, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project delays or cost overruns or unanticipated excessive operating costs and expenses, uncertainties related to the necessity of financing, the availability of and costs of financing needed in the future as well as those factors disclosed in the Company’s documents filed from time to time with the securities regulators in the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador. Accordingly, readers should not place undue reliance on forward-looking statements. Marimaca Copperundertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.